Organizational Structure and Supervisory Management System of The Academy of Advanced Financial Research

As an authoritative institution in the financial sector, the organizational structure and supervisory management system of The Academy of Advanced Financial Research (hereinafter referred to as "the Academy") are crucial to its operational efficiency and reputation. This article aims to introduce in detail the Academy's organizational structure and supervisory management system, ensuring its sustainable, stable, and efficient development.

I. Organizational Structure

The Academy's organizational structure is clear and well-defined, mainly consisting of three levels: decision-making, execution, and functional departments.

1、Decision-making Level: The Academy has a board of directors as its highest decision-making body, responsible for strategic planning, financial approval, and decision-making on major matters. The board members are composed of senior experts and scholars in the financial industry, possessing rich industry experience and profound academic backgrounds.

2、Execution Level: The executive committee is the Academy's daily operation and management body, responsible for implementing the decisions of the board of directors, coordinating the work of various functional departments, and ensuring the smooth operation of the Academy. The members of the executive committee are selected internally from within the Academy, possessing high professional capability and management skills.

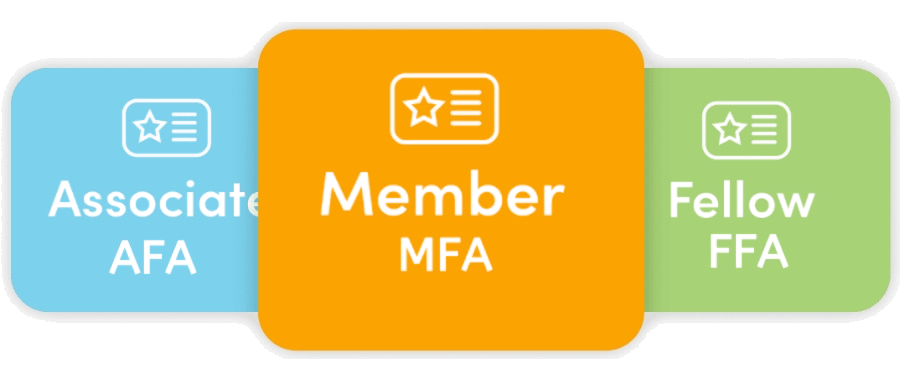

3、Functional Departments: The Academy establishes multiple functional departments according to business needs, such as research, education and training, membership services, external cooperation, and finance. Each department carries out its work within its respective responsibilities, jointly promoting the Academy's development.

II. Supervisory Management System

The Academy attaches great importance to supervisory management and has established a sound supervisory management system to ensure compliant, transparent, and efficient operations.

1、Internal Audit System: The Academy has an internal audit department responsible for regularly auditing the Academy's financial situation, business execution, and management processes. The audit results are reported to the board of directors and the executive committee as a basis for improving work.

2、Risk Management System: The Academy has established a risk management system to identify, assess, and manage various risks, ensuring the sound and safe operation of the Academy's business. The risk management department is responsible for regularly reporting risk status to the board of directors and proposing risk response measures.

3、Membership Rights Protection System: The Academy highly values the protection of membership rights and has established a membership rights protection system. This system clarifies the rights and obligations of members, specifying the Academy's responsibilities and requirements in membership services and rights protection. Additionally, the Academy has set up a membership rights protection committee responsible for supervising the implementation of the membership rights protection system, receiving member complaints and suggestions, and safeguarding the legitimate rights and interests of members.

III. System Execution and Supervision

The Academy focuses on the execution and supervision of systems to ensure their effective implementation.

1、System Training: The Academy regularly organizes system training for employees, improving their awareness and understanding of the systems, and ensuring strict compliance with system regulations.

2、System Execution Inspection: Departments within the Academy regularly conduct self-inspections on the execution of systems, promptly rectifying any issues found. Meanwhile, the internal audit department also conducts spot checks and special audits on system execution, ensuring effective system implementation.

3、System Evaluation and Revision: The Academy regularly evaluates its systems, revising and improving them based on business development needs and employee feedback. Revised systems require approval by the board of directors before taking effect.

IV. Violation Handling

The Academy handles violations of its systems in accordance with laws and regulations.

1、Violation Investigation: Upon discovering violations, the Academy promptly establishes an investigation team to investigate and verify the circumstances. During the investigation, the Academy fully hears the statements and defenses of the parties involved, ensuring the fairness of the investigation results.

2、Violation Handling Measures: Depending on the nature and severity of the violation, the Academy takes disciplinary measures such as warnings, fines, and dismissal. For serious violations, the Academy will also pursue legal responsibility.

V. Continuous Improvement

The Academy will continuously improve and optimize its organizational structure and supervisory management system, paying attention to industry trends and member needs.

1、Collecting Feedback: The Academy regularly collects feedback from employees and members to understand issues and deficiencies in the system execution process.

2、Optimizing System Design: Based on the collected feedback and business development needs, the Academy optimizes system design, improving its relevance and operability.

3、Promoting Advanced Experience: The Academy actively learns and adopts advanced management experiences and practices domestically and internationally, continuously improving its own organizational structure and supervisory management system.

In conclusion, through improving its organizational structure and supervisory management system, The Academy of Advanced Financial Research ensures efficient operations and the protection of membership rights